All Categories

Featured

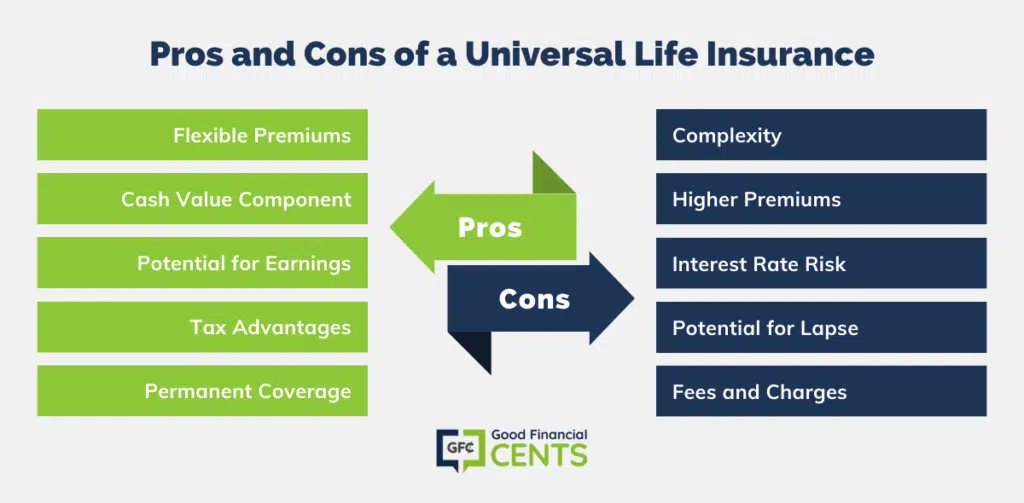

IUL agreements shield versus losses while providing some equity risk costs. High-net-worth people looking to lower their tax problem for retirement might profit from investing in an IUL.Some capitalists are far better off getting term insurance policy while maximizing their retirement plan contributions, instead than purchasing IULs.

While that formula is tied to the performance of an index, the amount of the credit rating is virtually always going to be less.

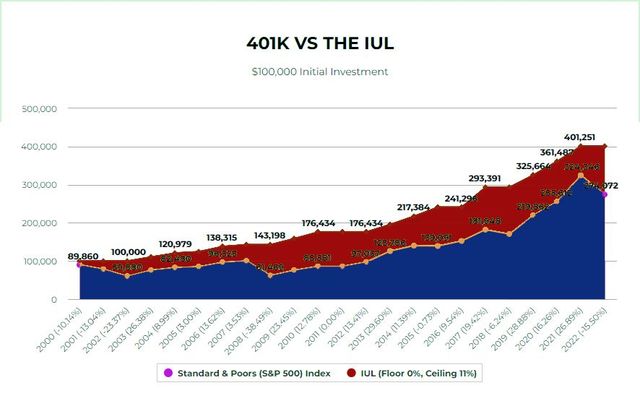

With an indexed universal life policy, there is a cap on the quantity of gains, which can restrict your account's development. If an index like the S&P 500 increases 12%, your gain could be a portion of that amount.

Iule

Irrevocable life insurance coverage trust funds have actually long been a preferred tax sanctuary for such people. If you fall into this category, take into consideration speaking to a fee-only economic consultant to discuss whether buying permanent insurance coverage fits your general technique. For many capitalists, though, it may be far better to max out on contributions to tax-advantaged pension, particularly if there are contribution suits from an employer.

Some plans have actually an ensured rate of return. One of the crucial features of indexed universal life (IUL) is that it provides a tax-free circulations.

Perfect for ages 35-55.: Deals adaptable protection with modest money value in years 15-30. Some points customers should think about: In exchange for the death benefit, life insurance coverage products bill fees such as death and expenditure danger charges and surrender charges.

Retirement preparation is crucial to maintaining financial security and retaining a specific standard of living. of all Americans are fretted about "maintaining a comfortable standard of life in retirement," according to a 2012 study by Americans for Secure Retired Life. Based on recent stats, this bulk of Americans are justified in their concern.

Division of Labor estimates that an individual will require to keep their existing requirement of living as soon as they start retired life. Furthermore, one-third of united state home owners, in between the ages of 30 and 59, will not be able to keep their requirement of living after retirement, even if they postpone their retirement until age 70, according to a 2012 study by the Fringe benefit Research Institute.

Iul Leads

In the same year those aged 75 and older held an ordinary financial debt of $27,409. Amazingly, that figure had even more than doubled given that 2007 when the ordinary debt was $13,665, according to the Worker Benefit Study Institute (EBRI).

56 percent of American retired people still had exceptional debts when they retired in 2012, according to a study by CESI Financial obligation Solutions. The Roth Individual Retirement Account and Policy are both tools that can be made use of to build considerable retired life cost savings.

These economic devices are comparable because they benefit insurance policy holders that wish to create savings at a lower tax rate than they might encounter in the future. Make each extra eye-catching for individuals with differing demands. Determining which is much better for you relies on your individual circumstance. In either situation, the plan expands based upon the passion, or returns, credited to the account.

That makes Roth IRAs perfect financial savings lorries for young, lower-income workers who live in a reduced tax bracket and that will gain from years of tax-free, compounded development. Considering that there are no minimum called for contributions, a Roth individual retirement account provides financiers regulate over their personal goals and take the chance of resistance. Additionally, there are no minimum needed circulations at any type of age throughout the life of the policy.

a 401k for workers and companies. To compare ULI and 401K strategies, take a minute to understand the essentials of both items: A 401(k) allows workers make tax-deductible contributions and delight in tax-deferred growth. Some employers will certainly match component of the employee's payments (freedom global iul ii). When employees retire, they typically pay tax obligations on withdrawals as common earnings.

Key Factors To Consider When Choosing Between Iul And 401(k)

Like other long-term life policies, a ULI plan also allots part of the costs to a money account. Given that these are fixed-index policies, unlike variable life, the plan will certainly additionally have an ensured minimum, so the money in the cash account will not decrease if the index decreases.

Plan owners will likewise tax-deferred gains within their cash account. They might also take pleasure in such various other economic and tax advantages as the capability to obtain against their tax account instead of taking out funds. Because method, universal life insurance can work as both life insurance and a growing asset. Check out some highlights of the advantages that universal life insurance policy can offer: Universal life insurance policies do not impose restrictions on the dimension of policies, so they might provide a way for workers to save even more if they have actually already maxed out the IRS restrictions for other tax-advantaged monetary products.

The IUL is better than a 401(k) or an Individual retirement account when it comes to conserving for retired life. With his almost 50 years of experience as a financial strategist and retired life preparation expert, Doug Andrew can show you specifically why this is the case.

Latest Posts

Life Insurance Surrender Cost Index

Equity Indexed Insurance

Guaranteed Universal Life Quotes